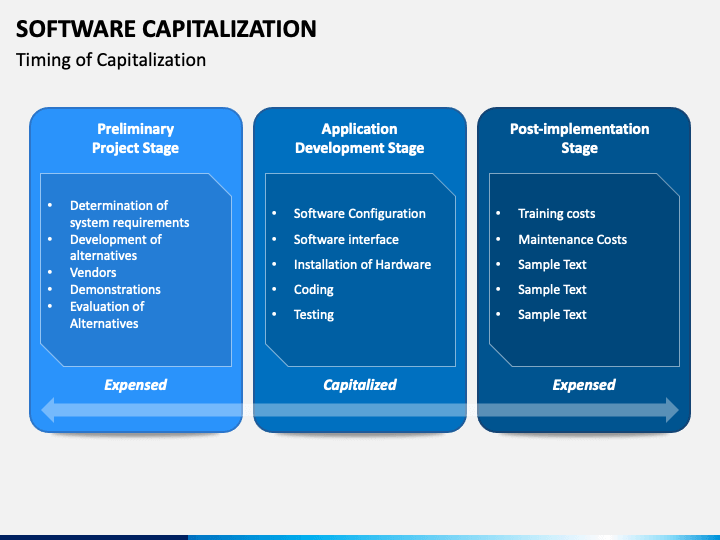

If a company is developing software for internal use, when are the costs expensed? - Universal CPA Review

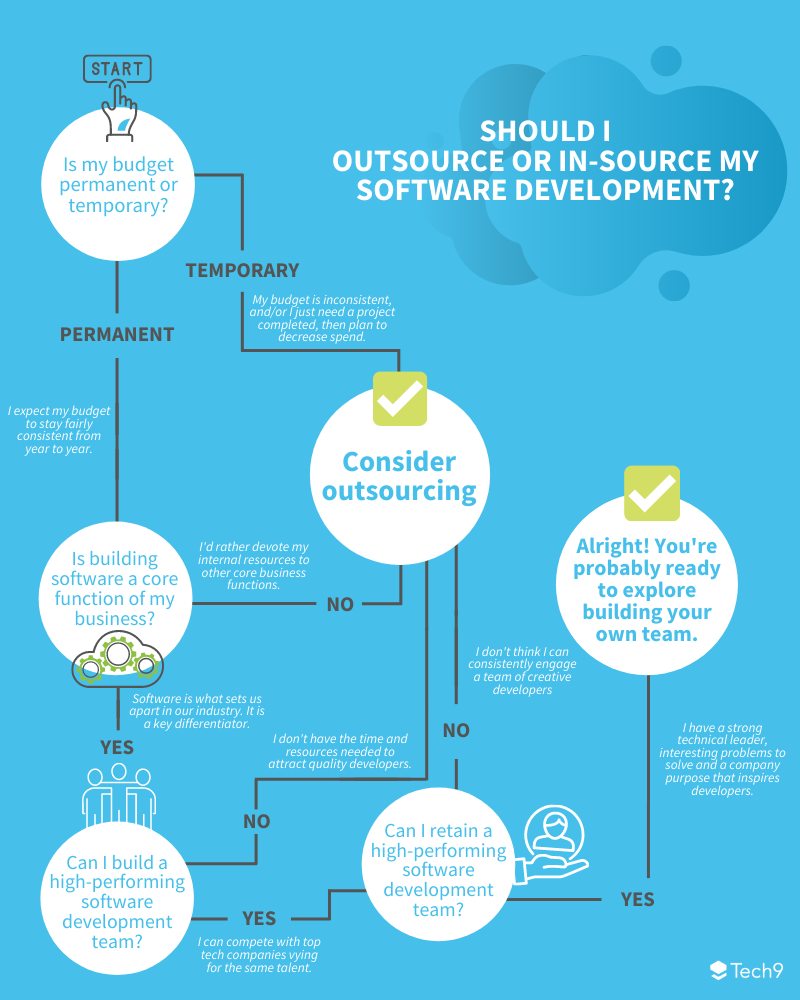

The Internal Developer Platform Revolution: A CTO's Guide to Transforming Software Development - Qovery

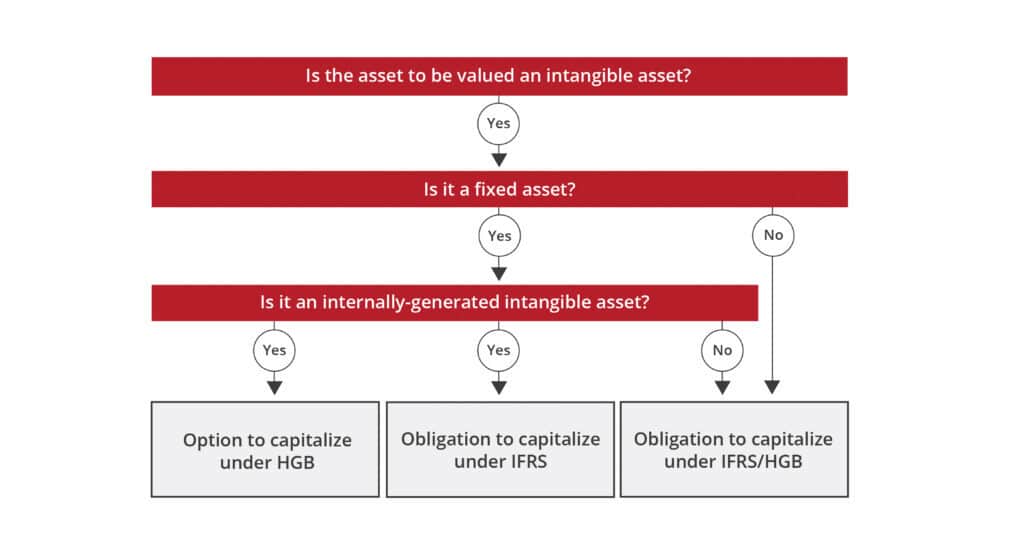

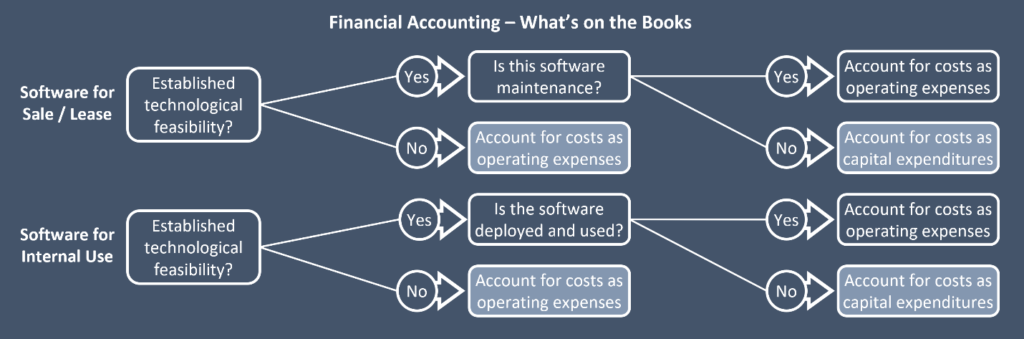

If a company is internally developing software to be sold, when can expenses be capitalized? - Universal CPA Review

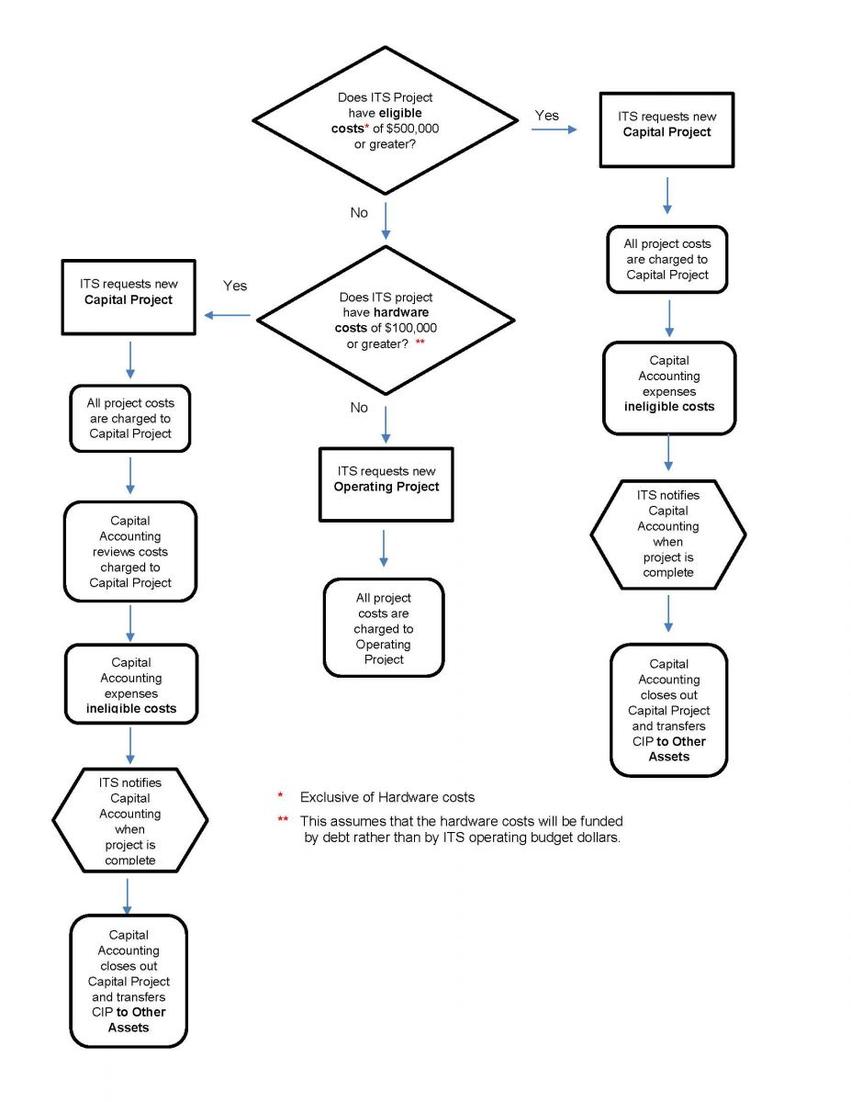

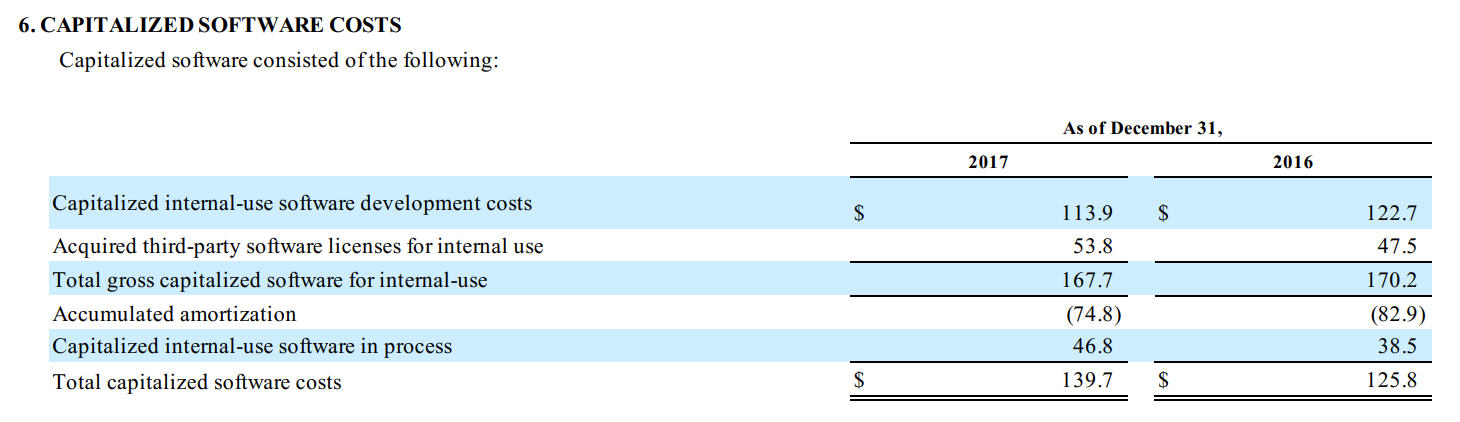

If a company is developing software for internal use, when are the costs capitalized? - Universal CPA Review

Accounting for Internal-Use Software Development Costs - Rivero Gordimer | CPA | Accounting | Payroll | Tampa Florida